Powering Bharat’s Digital Payments with

The UPI switch of The Future

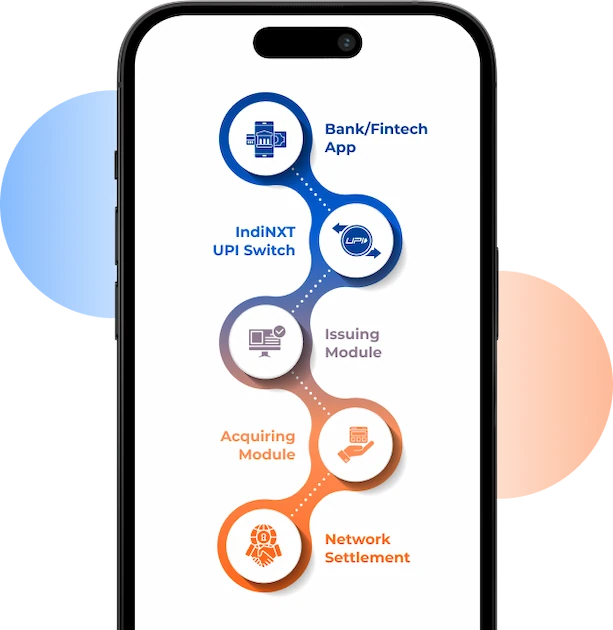

Experience enterprise-grade reliability, flexibility, and speed with IndiNXT — a UPI switch provider built for secure fintech infrastructure, processing millions of transactions seamlessly every day across Bharat.