Empowering TPAPs

with Secure, Scalable UPI Infrastructure

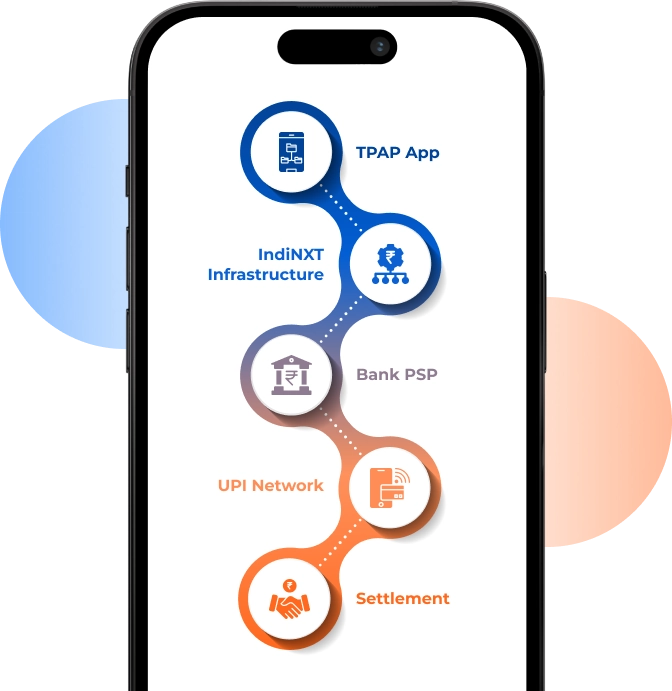

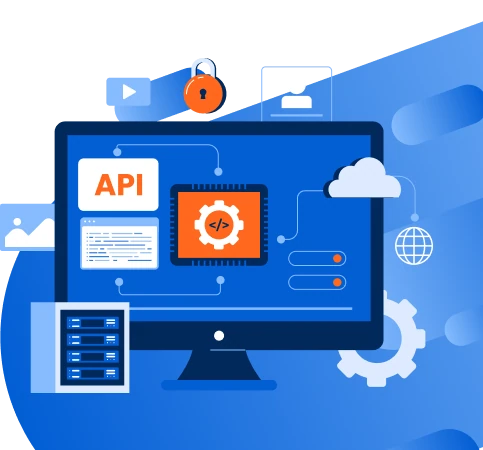

Build, launch, and scale UPI-powered payment applications with IndiNXT’s compliant, high-performance backend designed for Bharat’s digital finance ecosystem. Deliver seamless user experiences while maintaining trust, reliability, and regulatory alignment.